Obtaining a Seattle Business License Tax Certificate, commonly known as a Seattle business license or general business license, is mandatory for anyone conducting business activities within the City of Seattle. It’s an essential legal requirement, and understanding its application, renewal, and management processes can help you stay compliant and avoid potential penalties.

How to Apply for a Seattle Business License Tax Certificate

Seattle business licenses must be renewed annually by December 31st, regardless of when they were initially obtained. Business owners can conveniently apply for or renew their licenses online or by mail.

Applying Online via FileLocal

Seattle offers a user-friendly platform called FileLocal for business license applications and renewals. Business owners will usually need a Unified Business Identifier (UBI) number to start the application. If your business doesn’t legally require a UBI number, skip this step by selecting “Skip UBI Questions” and “Enter UBI Later.”

Upon completing the application online, new applicants can immediately print their temporary business licenses directly from the FileLocal portal, making the process quick and seamless.

Applying via Mail

Alternatively, you can apply by mail. First, download the application form from Seattle’s official website, complete it, and mail it along with your payment. Processing via mail typically takes between one to six weeks.

Lost or Misplaced Your Certificate?

If you’ve misplaced your business license tax certificate, Seattle’s licensing office can provide a replacement. Simply call (206) 684-8484 or email [email protected] to request a new copy.

Who Needs a Seattle Business License Tax Certificate?

Almost anyone operating a business in Seattle is required to hold a business license, including:

- Businesses providing professional or personal services

- Home-based businesses

- Manufacturing businesses

- Non-profit organizations

- Companies offering personal or professional services

- Any entity selling goods or services in Seattle

Important: Only the business owner must obtain the license; employees are not required to have individual certificates.

Cost and Annual Renewal of Seattle’s Business License

Seattle business license tax certificates expire annually on December 31st. To remain compliant, renewal must be completed before this deadline each year.

According to Seattle Ordinance 125083, the fee for the business license increases annually based on the previous year’s June-to-June consumer price index. This regulation ensures that license fees remain aligned with inflation, protecting city resources and supporting local infrastructure. The costs are as follows:

Staying Compliant: Renewal Deadline

Business owners must renew their Seattle Business License Tax Certificate annually by December 31st. Failure to renew on time may result in penalties or additional fees.

Penalties for Late Renewal

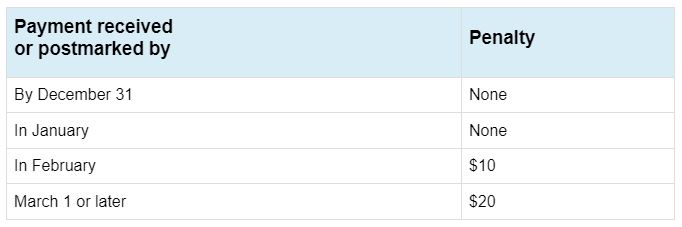

The City of Seattle may impose fines or penalties for late renewal. Timely renewal helps avoid unnecessary complications or disruptions in your business operations.

The following table shows the penalties for late payment.

Need Help Managing Your Seattle Short-Term Rental Business?

Navigating the complexities of Seattle licensing regulations and keeping your business fully compliant can be challenging. Consider partnering with a professional Airbnb management Seattle company that is experienced in ensuring complete compliance, licensing updates, and operational efficiency, freeing you to focus on growing your business.